Note: This section contains information in English only.

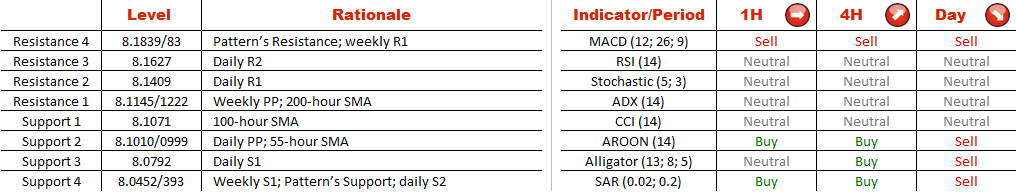

Inability of the US Dollar to appreciate above the weekly pivot point and downward-sloping 200-hour SMA is highly likely to result in a failure of this currency pair in the nearest future. USD/NOK has already struggled to gain value, when crossing both 55 and 100-hour SMAs earlier last week. A decline below 8.10 should trigger losses down to 8.0452 in the next few days, where weekly S1 coincides with daily S2 and Oct 14 low. This case is shared by daily indicators at the moment. However, 57% of all SWFX traders are bullish. In case the longs succeed in pushing the pair above 8.1220, they will target the 8.18-8.20 area next, where we look at the weekly R1 and upper trend-line of the pattern.

Inability of the US Dollar to appreciate above the weekly pivot point and downward-sloping 200-hour SMA is highly likely to result in a failure of this currency pair in the nearest future. USD/NOK has already struggled to gain value, when crossing both 55 and 100-hour SMAs earlier last week. A decline below 8.10 should trigger losses down to 8.0452 in the next few days, where weekly S1 coincides with daily S2 and Oct 14 low. This case is shared by daily indicators at the moment. However, 57% of all SWFX traders are bullish. In case the longs succeed in pushing the pair above 8.1220, they will target the 8.18-8.20 area next, where we look at the weekly R1 and upper trend-line of the pattern.

Mon, 19 Oct 2015 13:25:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.