Note: This section contains information in English only.

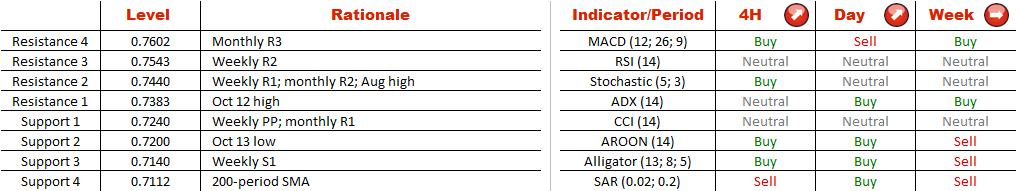

According to the latest price developments AUD/USD is more likely to start negating the Sep 29 - Oct 12 rally rather than to resume it. However, the four-hour and daily indicators remains bullish, and we look for a confirmation of the bearish outlook, which will be a close beneath the Oct 13 low (0.72). In this case the first major test of the downward momentum will be conducted by the 200-period SMA at 0.7112, while given the height of the pattern (180 pips), the decline could extend significantly lower, down to 0.7020. Alternatively, a breach of 0.7380 will leave for the pair little space for manoeuvre, since just 60 pips higher there is the August high reinforced by the monthly R2.

According to the latest price developments AUD/USD is more likely to start negating the Sep 29 - Oct 12 rally rather than to resume it. However, the four-hour and daily indicators remains bullish, and we look for a confirmation of the bearish outlook, which will be a close beneath the Oct 13 low (0.72). In this case the first major test of the downward momentum will be conducted by the 200-period SMA at 0.7112, while given the height of the pattern (180 pips), the decline could extend significantly lower, down to 0.7020. Alternatively, a breach of 0.7380 will leave for the pair little space for manoeuvre, since just 60 pips higher there is the August high reinforced by the monthly R2.

Fri, 16 Oct 2015 15:24:06 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.