Note: This section contains information in English only.

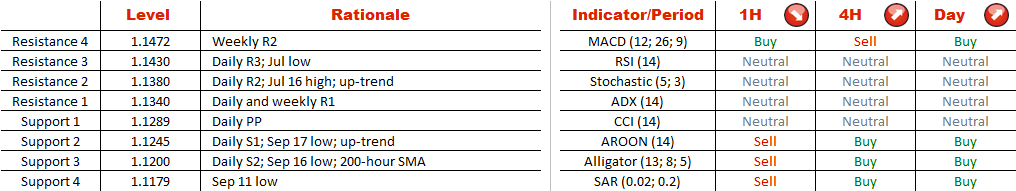

AUD/NZD preserved upward momentum after hitting the August highs. Accordingly, the currency pair is likely to keep trading between the two parallel trend-lines. In the short term the losses should be limited by 1.1245, where apart from the lower edge of the pattern we also have the daily S1 and Sep 17 low. If this demand level is broken, the Aussie will likely look for a test of 1.12 (200-hour SMA, Sep 16 low and daily S2). In the meantime, if the price moves north from here, AUD/NZD will be expected to start a bearish correction after it tests a dense supply area circa 1.1380. At the same time, a majority (64%) of the SWFX market participants expects the exchange rate to increase.

AUD/NZD preserved upward momentum after hitting the August highs. Accordingly, the currency pair is likely to keep trading between the two parallel trend-lines. In the short term the losses should be limited by 1.1245, where apart from the lower edge of the pattern we also have the daily S1 and Sep 17 low. If this demand level is broken, the Aussie will likely look for a test of 1.12 (200-hour SMA, Sep 16 low and daily S2). In the meantime, if the price moves north from here, AUD/NZD will be expected to start a bearish correction after it tests a dense supply area circa 1.1380. At the same time, a majority (64%) of the SWFX market participants expects the exchange rate to increase.

Fri, 18 Sep 2015 05:27:40 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.