Note: This section contains information in English only.

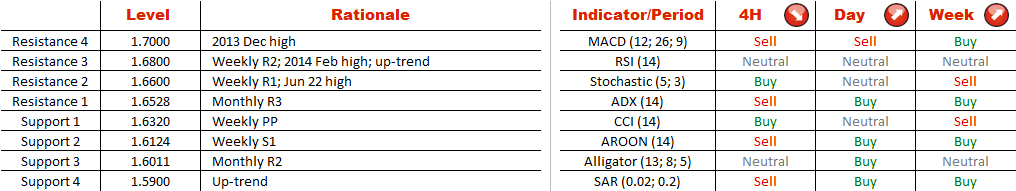

Considering that EUR/NZD has formed a bullish channel and most of the daily and weekly indicators are pointing upwards, being long the Euro is still reasonable. In the meantime, there is likely to be a sell-off from the upper boundary of the channel at 1.66 and down to the lower edge at 1.59 in the near term, as we expect a bearish correction before another up-move. If demand at 1.59 turns out to be insufficient, the next target will be the monthly R1 and weekly S2 at 1.58, followed by the 200-period SMA at 1.56. Despite the arguments in favour of a rally, the distribution between the bulls and bears is heavily skewed towards the latter, who take up 74% of the SWFX market.

Considering that EUR/NZD has formed a bullish channel and most of the daily and weekly indicators are pointing upwards, being long the Euro is still reasonable. In the meantime, there is likely to be a sell-off from the upper boundary of the channel at 1.66 and down to the lower edge at 1.59 in the near term, as we expect a bearish correction before another up-move. If demand at 1.59 turns out to be insufficient, the next target will be the monthly R1 and weekly S2 at 1.58, followed by the 200-period SMA at 1.56. Despite the arguments in favour of a rally, the distribution between the bulls and bears is heavily skewed towards the latter, who take up 74% of the SWFX market.

Wed, 24 Jun 2015 06:23:58 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.