Note: This section contains information in English only.

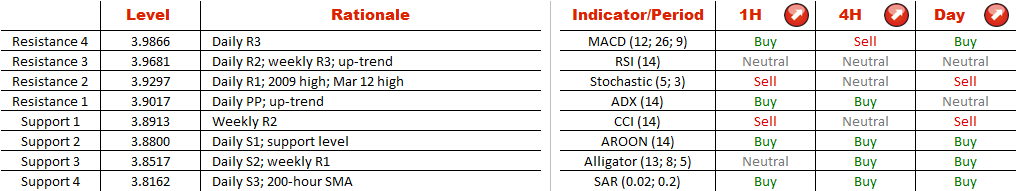

Although the pattern itself and most of the technical indicators imply that USD/PLN will retain bullish momentum, resistance at 3.93 still remains intact, which explains 74% of positions being short. Apart from the Mar 12 high and the daily R1, this level is represented by the historical 2009 high, meaning the pair may well fail to extend the gains. But if it succeeds, the bullish intentions will be confirmed, and 3.97, namely the upper boundary of the channel, will become the new target. At the same time, violation of the support trend-line at 3.90 should be followed by a sell-off to 3.88. Additional demand areas are supposed to be at 3.85 (weekly R1) and 3.81 (200-hour SMA).

Although the pattern itself and most of the technical indicators imply that USD/PLN will retain bullish momentum, resistance at 3.93 still remains intact, which explains 74% of positions being short. Apart from the Mar 12 high and the daily R1, this level is represented by the historical 2009 high, meaning the pair may well fail to extend the gains. But if it succeeds, the bullish intentions will be confirmed, and 3.97, namely the upper boundary of the channel, will become the new target. At the same time, violation of the support trend-line at 3.90 should be followed by a sell-off to 3.88. Additional demand areas are supposed to be at 3.85 (weekly R1) and 3.81 (200-hour SMA).

Fri, 13 Mar 2015 07:17:52 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.