Note: This section contains information in English only.

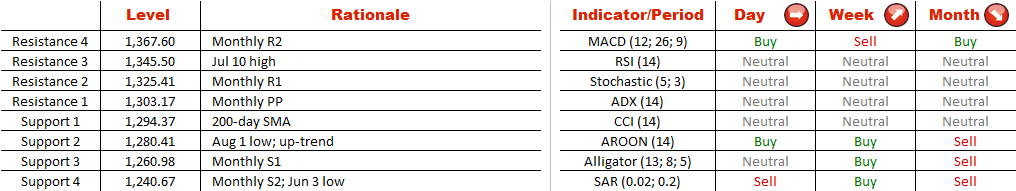

One can see the outlines of a symmetrical triangle on the daily chart of XAU/USD. After a precipitous decline (from 1,800 to 1,200), in the third quarter of 2013 the price entered a correction phase, which later on developed into a continuation pattern. Consequently, the gold is more likely to break the up-trend support line at 1,280 and resume depreciation than to violate the falling line at 1,325. The first scenario implies a decline through Jun 3 low at 1,240 towards the Dec 31 low near 1,180. The targets for an alternative scenario are going to be the Jul 10 high at 1,345.50 and Mar 16 high at 1,390. Meanwhile, the SWFX traders are undecided—56% of open positions are long.

One can see the outlines of a symmetrical triangle on the daily chart of XAU/USD. After a precipitous decline (from 1,800 to 1,200), in the third quarter of 2013 the price entered a correction phase, which later on developed into a continuation pattern. Consequently, the gold is more likely to break the up-trend support line at 1,280 and resume depreciation than to violate the falling line at 1,325. The first scenario implies a decline through Jun 3 low at 1,240 towards the Dec 31 low near 1,180. The targets for an alternative scenario are going to be the Jul 10 high at 1,345.50 and Mar 16 high at 1,390. Meanwhile, the SWFX traders are undecided—56% of open positions are long.

Mon, 18 Aug 2014 07:15:42 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.