Note: This section contains information in English only.

Tue, 22 Jul 2014 13:31:59 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

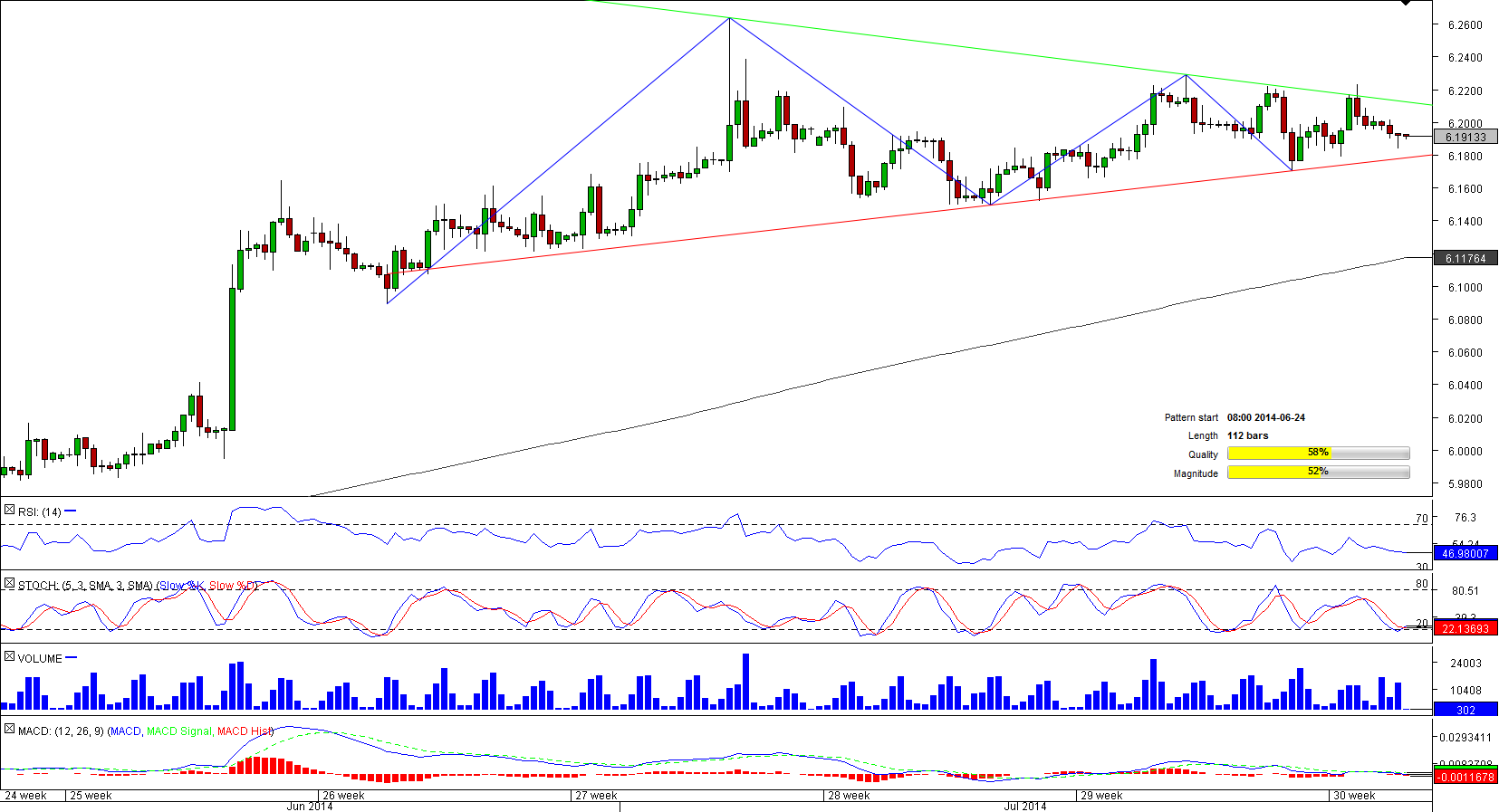

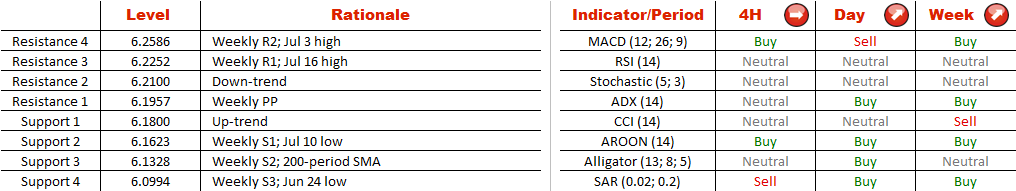

While on the 4H time-frame the chart looks more like an ascending triangle, an hourly chart resembles a symmetrical triangle. In any case, both patterns suggest the general bullish trend is going to persist. Accordingly, the consolidation should come to an end before we reach the apex of the triangle (Jul 29) by a break-out to the upside. This scenario is also supported by the daily and weekly technical studies. If this is the case, one of the first targets is going to be the weekly R1 and Jul 16 high at 6.2252, while the weekly R2 and Jul 3 high at 6.2586 is going to be one of the main objectives. However, the sentiment of the SWXF market towards USD/NOK is heavily bearish—74% of positions are short.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.