Note: This section contains information in English only.

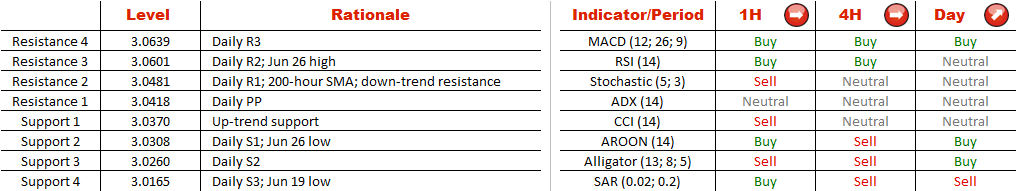

During the past two weeks the volatility of USD/PLN has been decreasing, which led to a formation of the symmetrical triangle. However, it is yet uncertain in which direction the break-out is going to occur, since there were no distinct trend before the pattern. According to the daily technical indicators and SWFX traders' sentiment (71% of positions long), there is a greater chance of a rally through a cluster of resistances at 3.0481 (down-trend, daily R1 and 200-hour SMA). If the bullish momentum persists, the price should then target Jun 26 high at 3.06. The next objective could be Jun 20 high at 3.0750.

During the past two weeks the volatility of USD/PLN has been decreasing, which led to a formation of the symmetrical triangle. However, it is yet uncertain in which direction the break-out is going to occur, since there were no distinct trend before the pattern. According to the daily technical indicators and SWFX traders' sentiment (71% of positions long), there is a greater chance of a rally through a cluster of resistances at 3.0481 (down-trend, daily R1 and 200-hour SMA). If the bullish momentum persists, the price should then target Jun 26 high at 3.06. The next objective could be Jun 20 high at 3.0750.

Tue, 01 Jul 2014 14:18:08 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.