Note: This section contains information in English only.

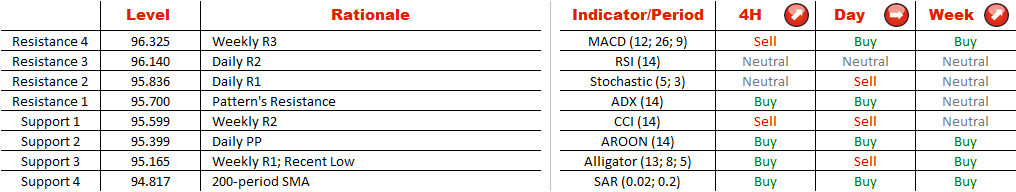

The AUD/JPY has been in correction since April. There is a broadening falling wedge on the 4H chart, with two recent highs moving slightly above the upper trend line. Moreover, the channel up pattern formed on May 21 is a clear indication of the strong uptrend. Keeping in mind traders are buying the pair in 59% of cases, as well as ‘buy' signals from technicals on the 4H and weekly charts, the outlook is bullish. A move above daily R1 will put two recent highs on the map, hence, long traders should focus on 96.108 and 96.250. Moreover, bulls will face resistance from daily R2 at 96.140, right between two major levels.

The AUD/JPY has been in correction since April. There is a broadening falling wedge on the 4H chart, with two recent highs moving slightly above the upper trend line. Moreover, the channel up pattern formed on May 21 is a clear indication of the strong uptrend. Keeping in mind traders are buying the pair in 59% of cases, as well as ‘buy' signals from technicals on the 4H and weekly charts, the outlook is bullish. A move above daily R1 will put two recent highs on the map, hence, long traders should focus on 96.108 and 96.250. Moreover, bulls will face resistance from daily R2 at 96.140, right between two major levels.

Fri, 06 Jun 2014 11:22:07 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.