Note: This section contains information in English only.

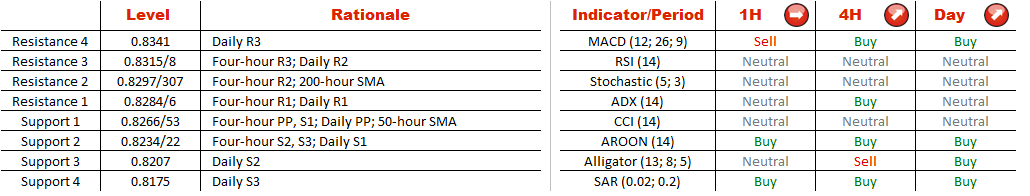

An eight-day decline performed by AUD/CHF started when the pair approached a seven-month high of 0.8394 in mid-May. Now the currency couple is wandering near the upper boundary of the 114-bar long bearish tunnel and considering a strong bullish sentiment –more than 77% of traders on the SWFX hold long positions- AUD/CHF may venture to exit the formation in the hours to come. If this comes true, the pair is likely to come under a notable buying pressure that may be mollified at the level of 0.8284/307 (four-hour R1, R2; daily R1; 200-hour SMA) and at the mark of 0.8315/8 (four-hour R3; daily R2); above these levels only 0.8341 (daily R3) is capable to put a lid on the expected AUD/CHF rise.

An eight-day decline performed by AUD/CHF started when the pair approached a seven-month high of 0.8394 in mid-May. Now the currency couple is wandering near the upper boundary of the 114-bar long bearish tunnel and considering a strong bullish sentiment –more than 77% of traders on the SWFX hold long positions- AUD/CHF may venture to exit the formation in the hours to come. If this comes true, the pair is likely to come under a notable buying pressure that may be mollified at the level of 0.8284/307 (four-hour R1, R2; daily R1; 200-hour SMA) and at the mark of 0.8315/8 (four-hour R3; daily R2); above these levels only 0.8341 (daily R3) is capable to put a lid on the expected AUD/CHF rise.

Fri, 23 May 2014 06:52:56 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.