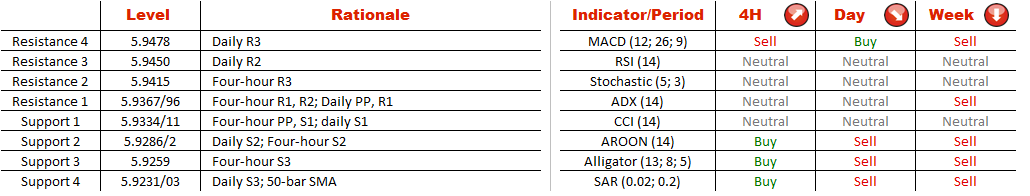

USD/NOK is likely to extend its losing streak in the hours to come, taking into account the SWFX sentiment- more than 76% of all orders are placed to sell the pair. If this comes true, the pair may plunge below 5.9334/11 (four-hour PP, S1; daily S1) and then it is likely to test 5.9286/59 (daily S2; four-hour S2, S3). A dive below the latter support zone will push to the fore the level of 5.9231/03 (dailyS3; 50-bar SMA) that is the last defence against a slide to the lower limit of the formation.

Note: This section contains information in English only.

A decline from a four-year high of 6.3151 hit by USD/NOK early February led to formation of the 218-bar long channel down pattern.

A decline from a four-year high of 6.3151 hit by USD/NOK early February led to formation of the 218-bar long channel down pattern.

USD/NOK is likely to extend its losing streak in the hours to come, taking into account the SWFX sentiment- more than 76% of all orders are placed to sell the pair. If this comes true, the pair may plunge below 5.9334/11 (four-hour PP, S1; daily S1) and then it is likely to test 5.9286/59 (daily S2; four-hour S2, S3). A dive below the latter support zone will push to the fore the level of 5.9231/03 (dailyS3; 50-bar SMA) that is the last defence against a slide to the lower limit of the formation.

Mon, 19 May 2014 06:54:55 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

USD/NOK is likely to extend its losing streak in the hours to come, taking into account the SWFX sentiment- more than 76% of all orders are placed to sell the pair. If this comes true, the pair may plunge below 5.9334/11 (four-hour PP, S1; daily S1) and then it is likely to test 5.9286/59 (daily S2; four-hour S2, S3). A dive below the latter support zone will push to the fore the level of 5.9231/03 (dailyS3; 50-bar SMA) that is the last defence against a slide to the lower limit of the formation.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.