Note: This section contains information in English only.

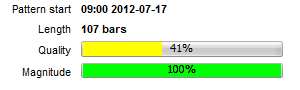

EUR/JPY has formed a Falling Wedge pattern on the 30M chart. The pattern has 41% quality and 100% magnitude in the 107-bar period.

EUR/JPY has formed a Falling Wedge pattern on the 30M chart. The pattern has 41% quality and 100% magnitude in the 107-bar period.

Fri, 20 Jul 2012 07:27:15 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

The pattern started when the pair rebounded from 97.386 and slowed down at 96.250 after testing pattern's support levels at 96.418 and 96.143. The CCI and the Stochastic indicators on 30M and 1H time horizons are sending buy signals. Long traders who expect to see some price correction could set the first target at 20th of July peak at 96.531. If this level is breached, next target would be at the pattern's resistance band at 96.586.

Technical indicators on aggregate point at further depreciation of the pair on 30M and 4H outlooks suggesting that the pair will continue to follow the general trend. The SWFX market sentiment shows that 40% of the traders share the same expectations. Short traders could set the first target at 4H retracement (Fibonacci) level at 56.250. If this level is breached, next targets might be at the recent low at 96.143 and at pattern's support band at 96.041.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.