© Dukascopy

"Monetary financing will set the wrong incentives, neglect the root causes of the problem, and destroy the credibility and trust in institutions"

- ECB governing council member (based on Reuters)

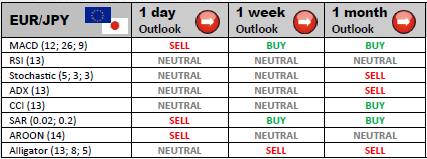

Industry outlook

For as long as resistances situated at 106.80 and 108.50 are untouched, the price is likely to trade off down to 104.75/26 and then erode it. Lower levels are at 103.08 and 100.77 - they should be able to halt any further dips.

Traders' sentiment

EUR/JPY traders' sentiment is presently mixed, as the quantity of long and short positions is nearly the same in the market. 49.33% of traders are bullish, while the rest, being 50.67%, anticipate yen's appreciation.

Long position opened

Leading market participants, who have entered EUR/JPY market with a buy trade, are expecting to close their positions at the key resistances at 106.47, 106.92 and 107.93.

Short position opened

Major dealers are planning to partially close their short positions if the pair touches upon the first support level at 105.46. However, if the bearish impetus proves to be strong enough, some of the positions could be squared off at S2 of 104.90 and at S3 of 103.89.

© Dukascopy