Note: This section contains information in English only.

Fri, 20 Nov 2015 08:29:33 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"We're still negative and target $985 in the short run."

- UBS Wealth Management (based on CNBC)

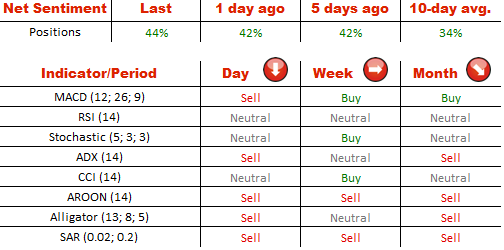

Gold surged the most since Oct 14 on Thursday, by jumping from July low at 1,070 towards the weekly pivot point at 1,084. Today we may observe a consolidation above the latter mark. Closure above 1,090 will mean that the bullion managed to fully erase this week's losses. Short term rally is possible as traders see the Fed's December rate hike looming, but the pace of tightening will be slow. Gains should be contained by the 1,100 mark, where the monthly S1 is placed at the moment. However, next week's development may provide gold with another downward momentum.

Market sentiment with respect to gold remains strongly positive for the moment, being that 72% of SWFX traders are holding long positions, up from 71% yesterday.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.