© Dukascopy

|

"At the moment, the franc remains highly valued, overvalued, and should depreciate again over time"

- Thomas Jordan, Swiss central bank Vice President (based on Bloomberg)

Industry outlook

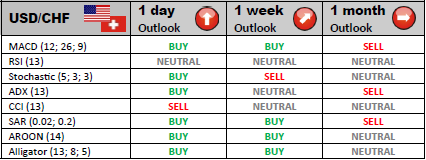

According to the industry outlook, the current uptrend is expected to stay in USD/CHF and assist the price in overcoming a key resistance situated at 0.9082. Further levels will be encountered at 0.9317, 0.9341 and 0.9399.

Traders' sentiment

USD/CHF market is static in term of different position held there and consequently without any major changes in the sentiment. Longs remain as the leading force, being formed by 72.3% of traders, at the same time 27.7% of the market believes that the Swiss franc will soon appreciate.

Long position opened

The break of the short-term resistance line 0.9035 would pave the way for the pair to rise up to 0.9123. The clearance of the second daily resistance level would establish a new target for traders at 0.9268.

Short position opened

The immediate support line is at 0.8890. Should the price step even lower, it will encounter subsequent levels at 0.8834 and 0.8689, where recovery might start.