Note: This section contains information in English only.

Wed, 03 Dec 2014 09:57:12 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"FOMC members are a little bit challenged by the fear that they don't want to rattle markets. It makes sense for them to proceed with caution."

- Deutsche Bank (based on Bloomberg)

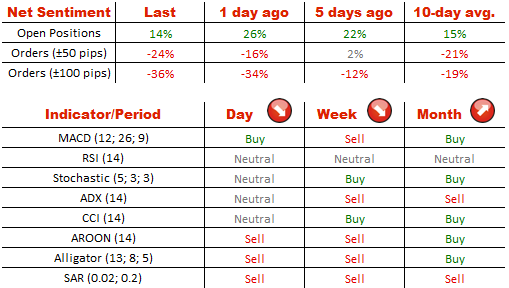

After a dive beneath the weekly PP at 1.5697, even the cluster of SMAs did not help to hold the pair near the 1.57 mark. Now the pair is fluctuating close to this year's low that was reached at the very beginning of December at 1.5585. We think that the likelihood of the currency couple approaching this year's low has increased since yesterday and it the bearish technicals only strengthen the possibility of this scenario.

Although there are relatively less people than yesterday considering that the British Pound is going to appreciate versus the US Dollar, they are still in majority (57%). In the meantime, the share of sell orders rose from 67% to 68%.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.