Note: This section contains information in English only.

"I don't see any major upside - turnout is expected to be at a historical low, and the markets will take that as a sign that voters aren't convinced about Abe's economic policies."

"I don't see any major upside - turnout is expected to be at a historical low, and the markets will take that as a sign that voters aren't convinced about Abe's economic policies."

Wed, 03 Dec 2014 09:46:44 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Daiwa (based on CNBC)

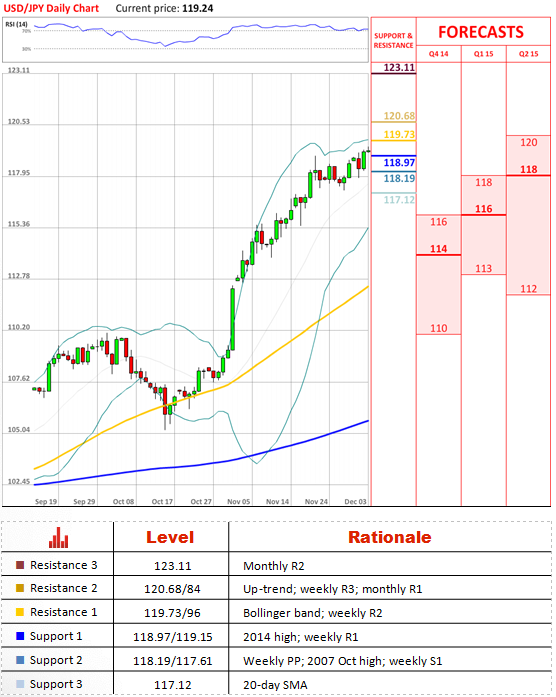

Pair's Outlook

USD/JPY has managed to surpass the 119 level that remained unbeaten beforehand. Currently, the pair is hovering around the weekly R1 that is located at 119.23, if this level continues to hold the pair above the major level at 119 we might see a test of the 120 level. Nonetheless, most likely the pair will have to gain more bullish momentum to breach the psychological level and possibly even to touch it.

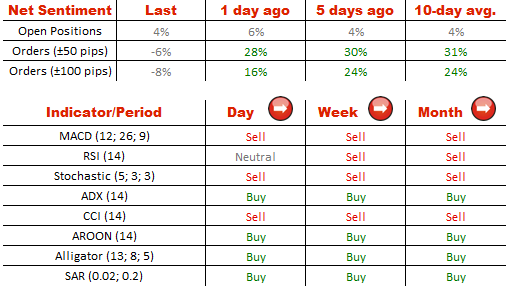

Traders' Sentiment

The sentiment of the SWFX market participants remains neutral with respect to USD/JPY, since only 52% of the market participants are long, the share of buy commands is falling and it has already reached a neutral level - 46%.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.