- TD Securities (based on CNBC)

Note: This section contains information in English only.

"The euro has been in a range with $1.35 as a bottom. The euro will probably trend lower now."

"The euro has been in a range with $1.35 as a bottom. The euro will probably trend lower now."

- TD Securities (based on CNBC)

Mon, 21 Jul 2014 07:02:20 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- TD Securities (based on CNBC)

Last week, despite the pair breaching a long-term down-trend, the bulls successfully defended the key level at 1.35, thus prodding EUR/USD to return to the monthly S1. However, given the number and density of the supply lying overhead, there is little chance the Euro will be able to sustain its current recovery. The price is likely to turn around either at 1.3563/53 or 1.3630/1.3598 and then pierce through 1.35, thereby confirming its bearish intentions.

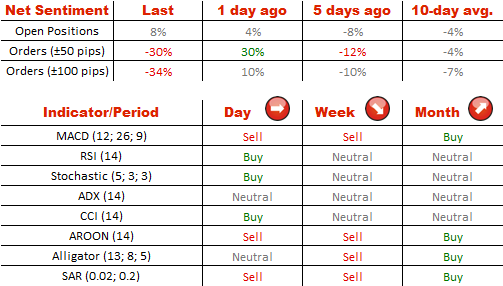

There are still no significant changes observed in the sentiment of the market towards EUR/USD—54% of traders are long and 46% are short. On the other hand, there has been a major increase in the sell orders near the spot—from 35% to 65% (50 pips around it).

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.