- CIBC World Markets (based on Reuters)

Note: This section contains information in English only.

"A good GDP number could see U.S. yields push higher. That should be supportive of the [U.S.] dollar."

"A good GDP number could see U.S. yields push higher. That should be supportive of the [U.S.] dollar."

- CIBC World Markets (based on Reuters)

Thu, 30 Jan 2014 15:28:40 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- CIBC World Markets (based on Reuters)

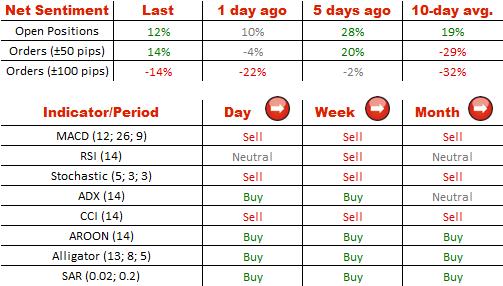

USD/CAD continues to gain ground after receiving a strong upward impetus near 1.10. The closest resistance is at 1.1218/1.1180, but it should not keep the currency pair busy for long, as it consists only of the weekly R1 and the Bollinger band. A similar situation is with the next resistance at 1.1298—the weekly R2. However, the technical indicators do not favour a bullish outlook, they are largely mixed.

The sentiment towards USD/CAD keeps on improving, but the percentage of long positions open in the market is still below the 10-day average of 59.5%, namely at 56%. Concerning the orders set around the current price, there is a slight advantage of sell ones (57%).

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.