Note: This section contains information in English only.

Thu, 26 Dec 2013 16:14:32 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"My view is that the dollar is still in an uptrend and is likely to rally further in 2014."

- Marshall Gittler, IronFX (based on MarketWatch)

Given that the resistance at 0.8925/03 denied an attempt of AUD/USD to rise further, the bearish channel (in place since Oct 23) retains its topicality. Accordingly, this substantially increases the probability of a new low appearing on the chart. This dip may also extend through the monthly S2 at 0.8746 and reach 0.8700/88, the lower boundary of the downward-sloping corridor.

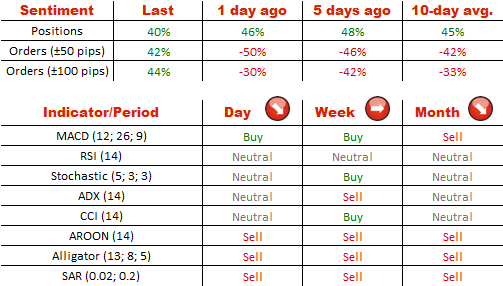

Just as in EUR/JPY, the ratio between the buy and sell orders in AUD/USD was subject to a noticeable change. Within 100 pips from the spot the share of buy orders soared from 35% up to 72%. Meanwhile, the portion of long positions remains more or less the same and is currently at 70%.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.