Note: This section contains information in English only.

Mon, 16 Dec 2013 16:21:18 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"There's a growing sense that the RBNZ could look at raising interest rates, but they're not quite there yet and that's to do with the high exchange rate."

- St. George Bank Ltd. (based on Bloomberg)

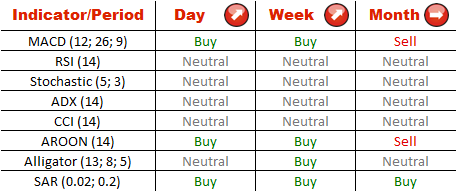

Pair ended last week and started this week demonstrating mild bullishness, at the moment is aiming at 55-day SMA, but it is to early to say if it will remain range bound between 0.823 and 0.833 as it was last week. If the 55-day SMA will be breached, it would put weekly and monthly R1 on the map. In case of a dip below 0.8263 we should start looking at 20 and 100-day SMA/monthly PP/weekly S1 at 0.8226/191.

Bears continue to dominate the market as they hold 71%, 1% less than on Friday, of open positions on the pair. We are not expecting to see any major changes as pending orders are continuing to be equally divided between the long and short traders.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.