Note: This section contains information in English only.

Fri, 30 Nov 2012 16:12:01 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"We don't think an actual cut next week will put too much downward pressure on Aussie -- a lot of the cuts are already factored into the market."

- Commonwealth Bank of Australia (based on Bloomberg)

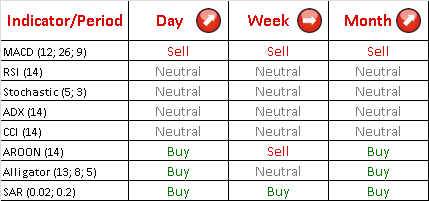

The bearish reaction, which occurred yesterday, has successfully managed to continue, as today the AUD/USD currency pair experienced another consequent movement downwards, and now the price is about to test the 20-day SMA at 1.0406, which is very likely to stop the bearish tendency. Nevertheless, the overall indicator outlook is positive, therefore supporting the potential tendency change in the upcoming week.

The bearish expectations prevail at the market, since 72% of traders hold short positions, however the situation with orders is more neutral, as 47% of them are to buy and 53% of them are to sell the Australian Dollar.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.