Note: This section contains information in English only.

Tue, 13 Nov 2012 15:59:11 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"I don't think there's any fundamental change (in the kiwi) unless equities keep going lower."

- ASB Institutional (based on TVNZ)

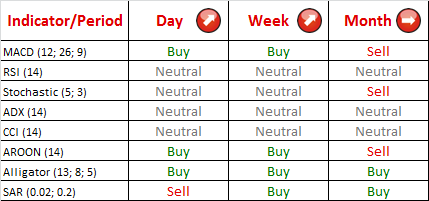

Pair continues to advance after receiving a bullish impetus from 100-day SMA yesterday. It has been briefly paused by weekly pivot and 200-day SMA but it is very likely pair will try to advance above these levels later in the session, but as readings of technical indicators are inconclusive it seems that bearish market sentiment will drag pair down back eventually.

Share of bears decreased by 4% since yesterday, but they continue to hold overwhelming majority, 71% to be exact, of positions in the market. In addition, pending short orders account for 68% of all pending orders in the market. As a consequence we should continue to see bear dominated market in the near future.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.