Traders' Sentiment

Note: This section contains information in English only.

Traders' Sentiment

Tue, 21 Aug 2012 14:54:16 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"The market was looking for a fair bit more commentary on the Aussie dollar itself following the monetary policy statement a week and a half ago as well as the statement accompanying the policy decision where the RBA seemed to ramp up its rhetoric about the currency."

-David Forrester, Macquirie Bank (based on Bloomberg)

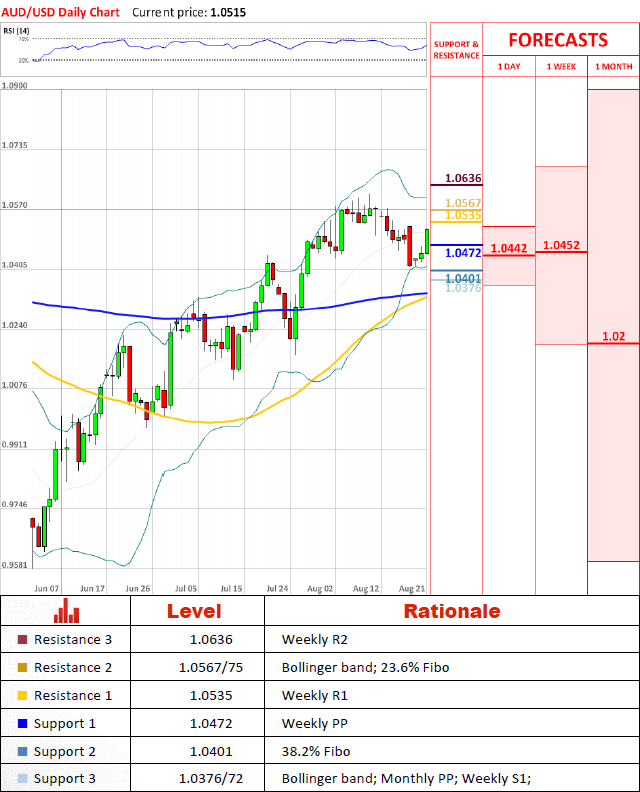

Pair's Outlook

Pair has returned to levels prior to sharp drop at the end of last week and should continue developing normally further. Weekly R1 should not allow the pair to appreciate further for some time now and contain in 1.0472/1.0535 range.

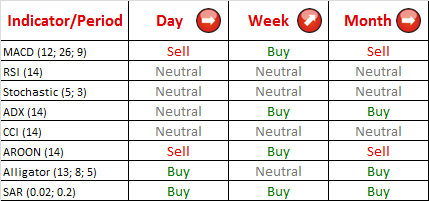

Traders' Sentiment

Bearish sentiment remains at 74% mark after increasing by 5% after the weekend. The distribution of pending orders shifted from 59% of buy orders to 67% of sell orders since yesterday suggesting a further strengthening of bearish sentiment.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.