Note: This section contains information in English only.

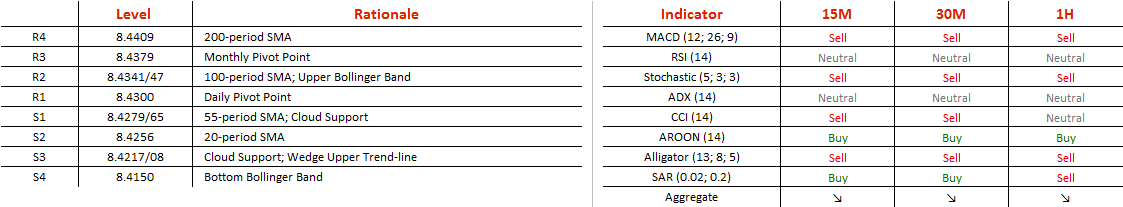

USD/NOK set a December high at 8.5290 a few days before, but went on to dive 1.6% inside a falling wedge pattern. The pair has just dashed through the upper trend-line of the wedge as well as a red Ichimoku cloud and is now on its way to test 8.4300, the daily Pivot Point. It now appears that a decisive reversal in on the way, initiated by a retracement of the broken trend-line at 8.4151. There are a lot of levels to watch now, such as 8.4278, 8.4341 and 8.4379, with the last immediate supply zone at 8.4408, the 200-period SMA. The multitude of levels could bring some flatness into the motion and lead to longer period of time for pushing through.

USD/NOK set a December high at 8.5290 a few days before, but went on to dive 1.6% inside a falling wedge pattern. The pair has just dashed through the upper trend-line of the wedge as well as a red Ichimoku cloud and is now on its way to test 8.4300, the daily Pivot Point. It now appears that a decisive reversal in on the way, initiated by a retracement of the broken trend-line at 8.4151. There are a lot of levels to watch now, such as 8.4278, 8.4341 and 8.4379, with the last immediate supply zone at 8.4408, the 200-period SMA. The multitude of levels could bring some flatness into the motion and lead to longer period of time for pushing through.

Wed, 14 Dec 2016 08:38:30 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.