Note: This section contains information in English only.

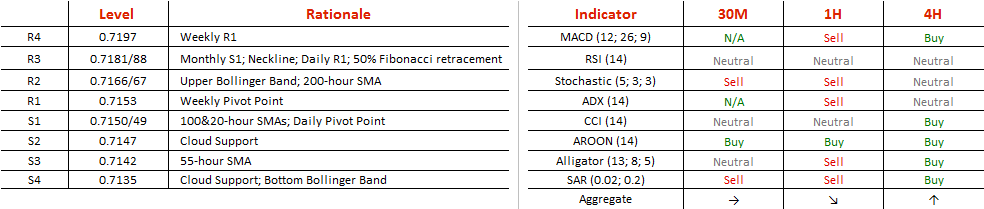

While an attempt at reversing the previous downtrend failed on the fifth wave, USD/NZD went on to repeat the motion, forming a double bottom at 0.7118 with a neckline at 0.7182. A close above this level would confirm a change of trend and set the next major target at 0.7247 where October 20 highs lay – a scenario quite likely unless 0.7166/0.7168 rejects the surge. Supply pressures at 0.7149/50 could elevate the pair towards targeted levels, and a motion below would cause the opposite. Trading above the cloud resistance, the rate could still fail to break the neckline, strengthened by the Daily R1, monthly S1 and the 50% retracement level of the latest dive, which would lead to a rectangle formation.

While an attempt at reversing the previous downtrend failed on the fifth wave, USD/NZD went on to repeat the motion, forming a double bottom at 0.7118 with a neckline at 0.7182. A close above this level would confirm a change of trend and set the next major target at 0.7247 where October 20 highs lay – a scenario quite likely unless 0.7166/0.7168 rejects the surge. Supply pressures at 0.7149/50 could elevate the pair towards targeted levels, and a motion below would cause the opposite. Trading above the cloud resistance, the rate could still fail to break the neckline, strengthened by the Daily R1, monthly S1 and the 50% retracement level of the latest dive, which would lead to a rectangle formation.

Mon, 31 Oct 2016 08:30:48 GMT

Source: Dukascpy Bank SA

© Dukascpy Bank SA

© Dukascpy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.