Note: This section contains information in English only.

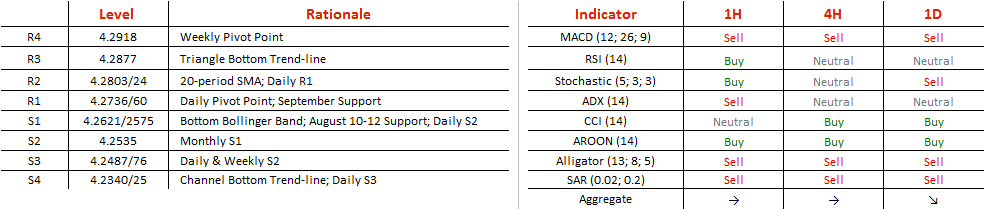

EUR/PLN entered a descending channel pattern just to exit the symmetrical triangle it had developed arguably since June. The break below took place on October 6 at 4.2871, causing a retracement and tests of 4.2665, the weekly S1 Tuesday morning. With 4.2535 serving as the next target, we look for an extension of the bearish market and the channel pattern, leaving SMAs above to provide supply pressures for a smoother fall. The 4.2601 area is likely to put up a battle before that, as it did on August 10-12, when the pair's weakness was rejected. Fixing level 4.2330 as the ultimate target of the current wave, the rate will tap at the bottom trend-line and gain value to touch the upper trend-line next.

EUR/PLN entered a descending channel pattern just to exit the symmetrical triangle it had developed arguably since June. The break below took place on October 6 at 4.2871, causing a retracement and tests of 4.2665, the weekly S1 Tuesday morning. With 4.2535 serving as the next target, we look for an extension of the bearish market and the channel pattern, leaving SMAs above to provide supply pressures for a smoother fall. The 4.2601 area is likely to put up a battle before that, as it did on August 10-12, when the pair's weakness was rejected. Fixing level 4.2330 as the ultimate target of the current wave, the rate will tap at the bottom trend-line and gain value to touch the upper trend-line next.

Tue, 11 Oct 2016 06:23:44 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.