Note: This section contains information in English only.

Mon, 30 May 2016 14:14:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

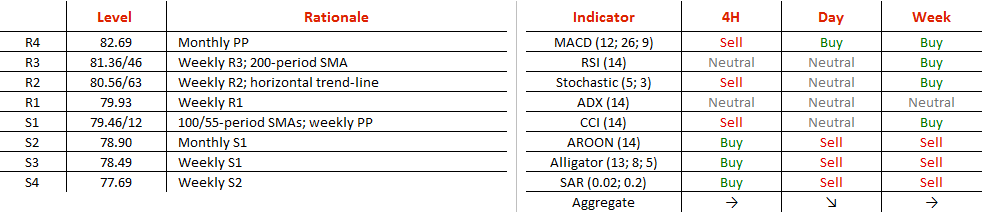

The Australian Dollar's outlook against the Japanese Yen is strongly positive. Over the past four weeks the bears have failed three times to send the pair much below the 78.40 zone, meaning the upside pressure there is on the rise. While the intermediate resistance is now represented by the weekly R1 at 79.93, the most crucial test will take place near 80.56 when AUD/JPY will confront the second weekly supply along with the horizontal trend-line of the pattern. A bullish failure here, as still indicated by the daily technical indicators, would mean the pair will be set on course to form a rectangle pattern. Alongside, their success will expose another vital resistance, namely the 200-period SMA at 81.46.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.