Note: This section contains information in English only.

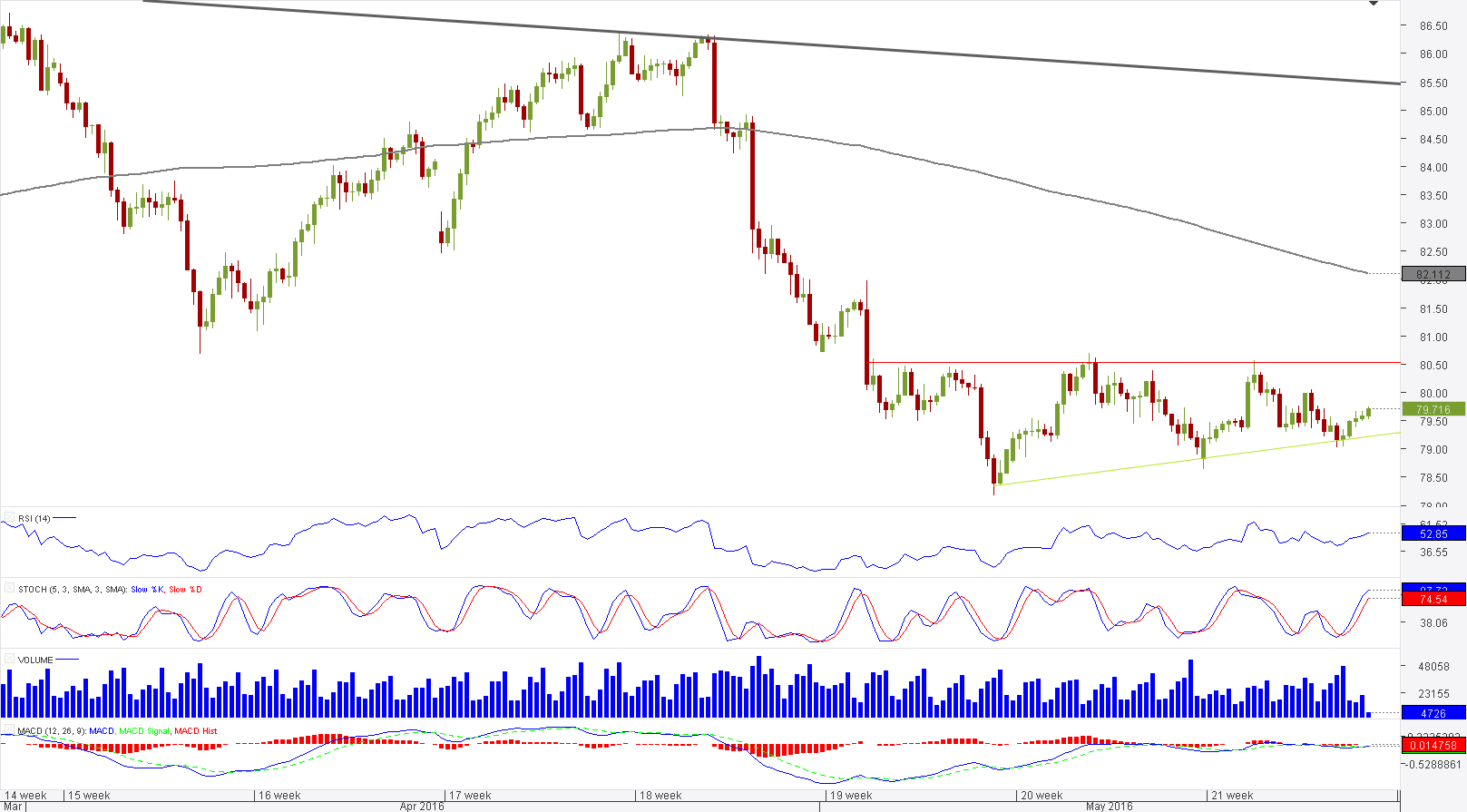

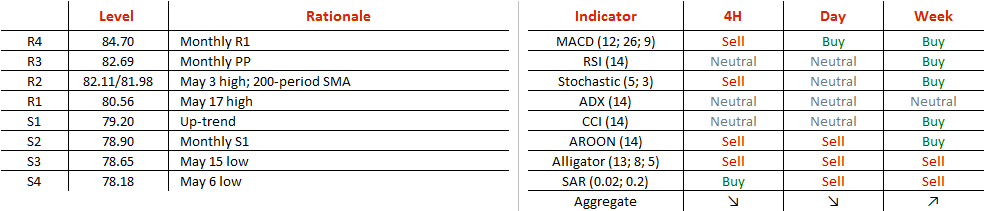

Although the Aussie has been heavily sold off since the end of April, there is a good chance the bearish momentum is soon to give way for a rally, at least in the near term. The main reason to be bullish on AUD/JPY is the way the pair consolidates—it is forming an ascending triangle, which implies growing demand. Accordingly, if the price closes above 80.50, we will expect the rate to climb higher, potentially up to 82 yen, where the 200-period SMA coincides with the May 3 high. A longer-term recovery, however, is to be capped by the 13-month down-trend at the level of 85 yen, being that there is hardly any room for new buyers to enter the market—74% of positions are long.

Although the Aussie has been heavily sold off since the end of April, there is a good chance the bearish momentum is soon to give way for a rally, at least in the near term. The main reason to be bullish on AUD/JPY is the way the pair consolidates—it is forming an ascending triangle, which implies growing demand. Accordingly, if the price closes above 80.50, we will expect the rate to climb higher, potentially up to 82 yen, where the 200-period SMA coincides with the May 3 high. A longer-term recovery, however, is to be capped by the 13-month down-trend at the level of 85 yen, being that there is hardly any room for new buyers to enter the market—74% of positions are long.

Fri, 20 May 2016 06:27:20 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.