Note: This section contains information in English only.

Wed, 04 May 2016 14:14:06 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

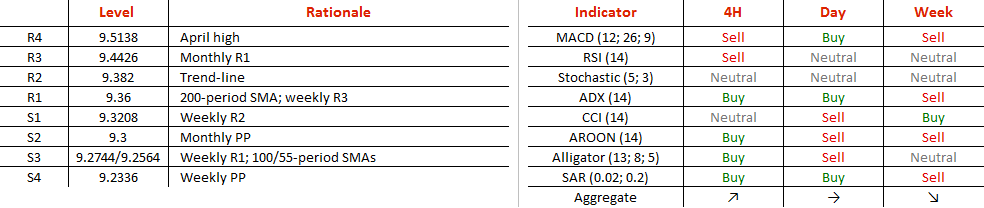

This cross is also likely to face losses, but within the channel down the likelihood of such a move is much higher. EUR/NOK has already met the 200-period SMA, currently at 9.36, which is boosted by the last weekly resistance of the May 2-6 period. They both are followed by the pattern's upper boundary at 9.3820, meaning at least for now the bullish success is hardly achievable. On top of that, weekly technical indicators are still suggesting that the Euro should be a subject to extra weakness until Friday of this week. To affirm strength on the bearish side, the pair has to fall beyond the monthly pivot point of 9.30. Nonetheless, in case there is a rally, the Euro should watch the April high at 9.5138.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.