Note: This section contains information in English only.

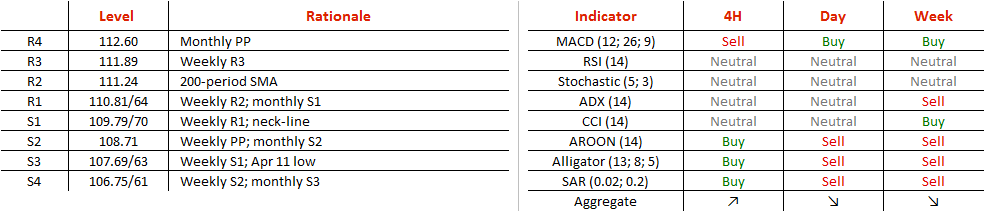

USD/JPY has just broken the neck-line of the double bottom pattern, which implies further appreciation of the US Dollar. The height of the pattern implies a rally towards the weekly R3 near 112 yen, but we may expect the recovery to extend up to the March 29 high just below the level of 114 yen. The immediate resistance is at 110.81/64, represented by the weekly R2 and monthly S1. If this obstacle is overcome, the next target should be the 200-period SMA at 111.24. However, we would like to note that the technical studies, especially in the daily and weekly charts, are against stronger Greenback. Also, the US Dollar is overbought against the Yen: as many as 72% of positions are long.

USD/JPY has just broken the neck-line of the double bottom pattern, which implies further appreciation of the US Dollar. The height of the pattern implies a rally towards the weekly R3 near 112 yen, but we may expect the recovery to extend up to the March 29 high just below the level of 114 yen. The immediate resistance is at 110.81/64, represented by the weekly R2 and monthly S1. If this obstacle is overcome, the next target should be the 200-period SMA at 111.24. However, we would like to note that the technical studies, especially in the daily and weekly charts, are against stronger Greenback. Also, the US Dollar is overbought against the Yen: as many as 72% of positions are long.

Fri, 22 Apr 2016 07:03:05 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.