Note: This section contains information in English only.

Tue, 12 Apr 2016 14:00:23 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

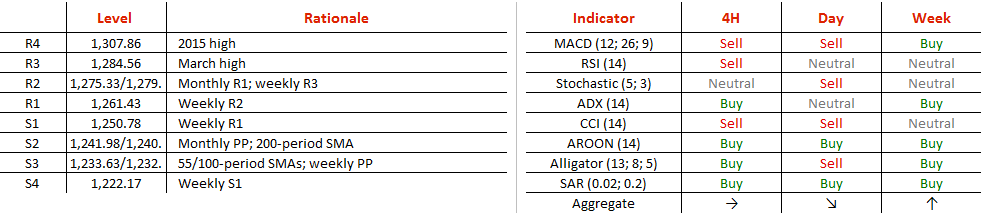

Gold is poised for more price gains, as the metal succeeded in confirming the descending triangle it traded in until early April. Along with crossing the pattern's upper edge, XAU/USD eroded the 200-period SMA and the monthly pivot point at 1,240 and 1,241, respectively. This fact is boosting the future outlook even more. Although short-term dips are not off the table, they are likely to be shallow. In the weeks to come the bullion should continue aiming at the recently-reached March peak at 1,284.56. The second major supply zone lies at 1,307 (2015 high). Over the last two days the number of short SWFX positions soared to 67%, but too pessimistic current views may eventually begin backing the bulls.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.