Note: This section contains information in English only.

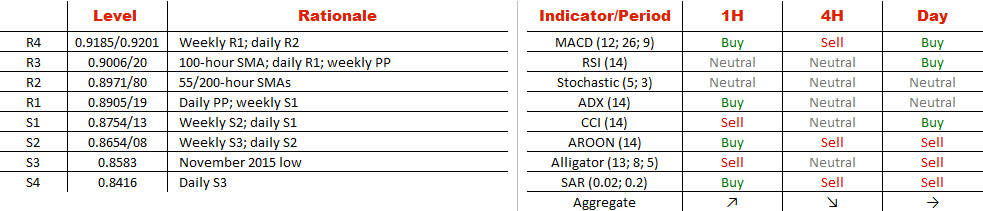

The outlook for the Kiwi against the Canadian Dollar remains subdued, after the currency pair fell on Wednesday after the RBNZ curbed interest rates, while the Bank of Canada stood on hold. The triangle pattern, where NZD/CAD has traded since February 23, has therefore been confirmed to the downside. On the side of the bears, 55-hour SMA has just crossed the 200-hour SMA to the South, meaning sentiment of the cross is becoming even more bearish. On top of that, 60% of SWFX traders are going short on the Kiwi at the moment. Initially, the pair is expected to test the weekly S2 at 0.8754. However, only a drop below weekly S3 at 0.8654 may force a sell-off down to the Nov low at 0.8583.

The outlook for the Kiwi against the Canadian Dollar remains subdued, after the currency pair fell on Wednesday after the RBNZ curbed interest rates, while the Bank of Canada stood on hold. The triangle pattern, where NZD/CAD has traded since February 23, has therefore been confirmed to the downside. On the side of the bears, 55-hour SMA has just crossed the 200-hour SMA to the South, meaning sentiment of the cross is becoming even more bearish. On top of that, 60% of SWFX traders are going short on the Kiwi at the moment. Initially, the pair is expected to test the weekly S2 at 0.8754. However, only a drop below weekly S3 at 0.8654 may force a sell-off down to the Nov low at 0.8583.

Thu, 10 Mar 2016 14:48:10 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.