Note: This section contains information in English only.

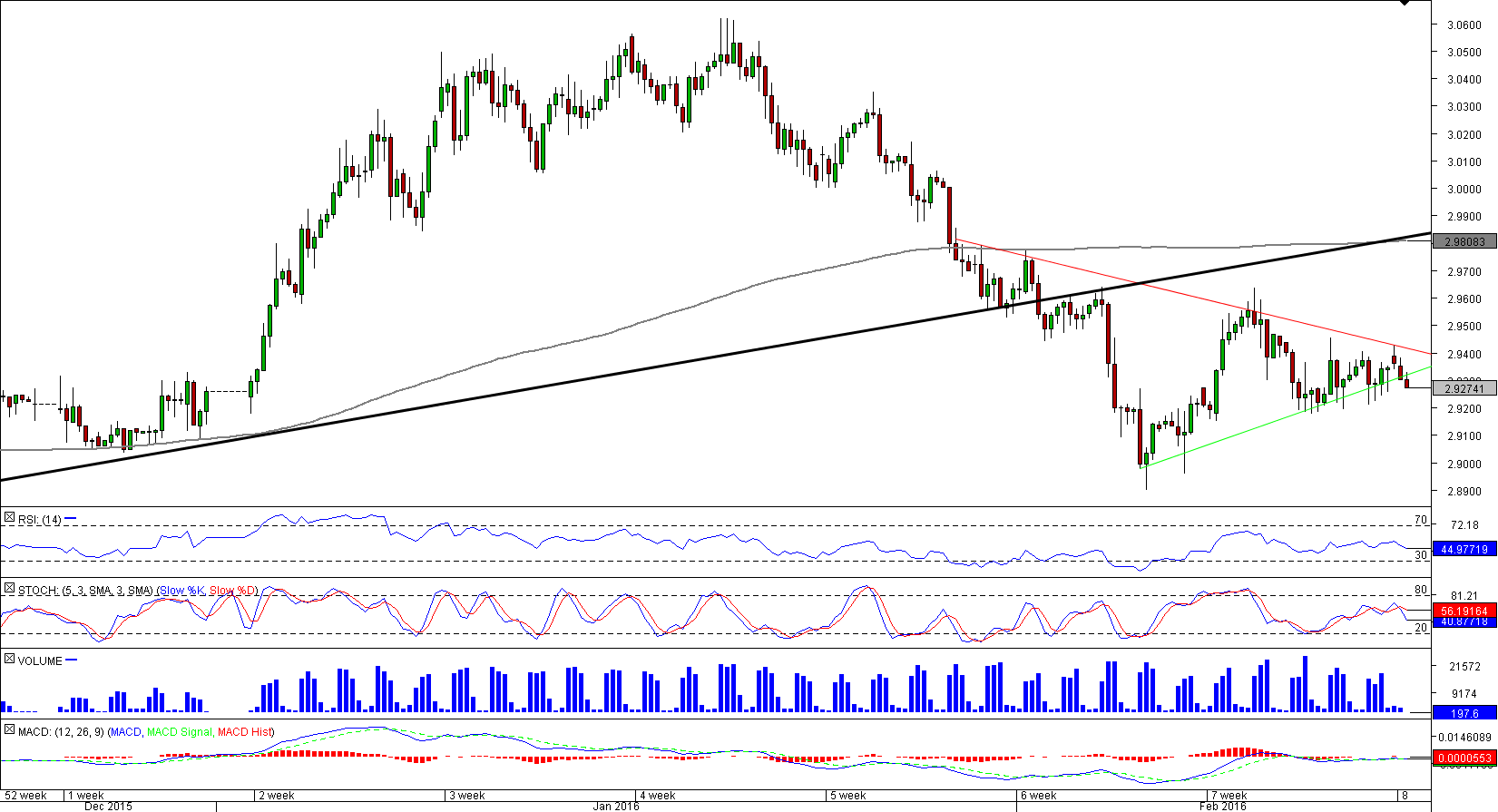

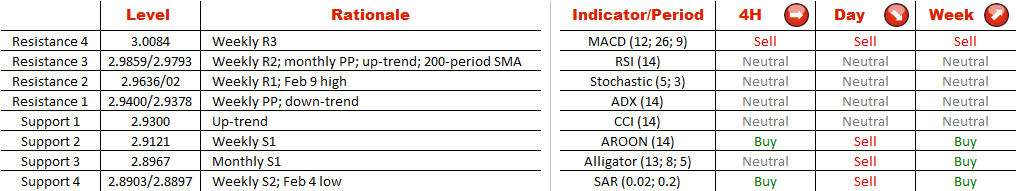

USD/TRY has recently broken through the 15-month up-trend, which implies a strong negative long-term bias. In addition, there is a triangle emerging after a sell-off, further strengthening the case for weakening Dollar. USD/TRY is expected to close beneath 2.93 and resume the decline. And while the rate is highly likely to pass through the monthly S1 and February 4 low, bears might find it difficult to push the price beneath the 2.87/2.86 demand area. There, apart from the weekly S3 and December low, is the 200-day SMA. On the other hand, even if the Greenback jumps above 2.94, there is a nearly impenetrable supply area between 2.9850 and 2.98 that should trigger active selling.

USD/TRY has recently broken through the 15-month up-trend, which implies a strong negative long-term bias. In addition, there is a triangle emerging after a sell-off, further strengthening the case for weakening Dollar. USD/TRY is expected to close beneath 2.93 and resume the decline. And while the rate is highly likely to pass through the monthly S1 and February 4 low, bears might find it difficult to push the price beneath the 2.87/2.86 demand area. There, apart from the weekly S3 and December low, is the 200-day SMA. On the other hand, even if the Greenback jumps above 2.94, there is a nearly impenetrable supply area between 2.9850 and 2.98 that should trigger active selling.

Mon, 15 Feb 2016 07:01:51 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.