Note: This section contains information in English only.

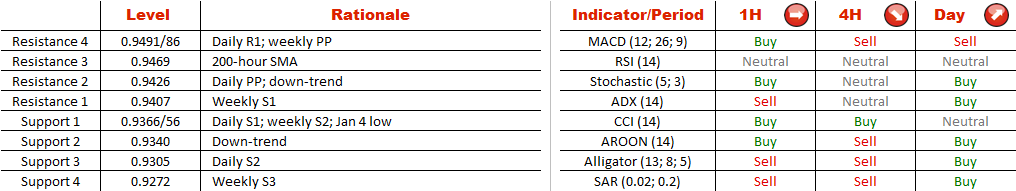

We hold a bearish outlook on the New Zealand Dollar this week. The currency pair has recently broken through the long-term moving average and formed a descending channel. The near-term rallies are to be capped by the falling resistance line at 0.9426, while the target is the December 15 low at 0.9242. However, the upside risks are not negligible. First, most of the daily technical indicators are giving ‘buy' signals. Secondly, the Kiwi is oversold in the SWFX market, being that 73% of positions are already short. Above 0.9426 will likely aim for the 200-hour SMA at 0.9468 and the weekly PP at 0.9491. Additional resistance is at 0.9546/33, created by the December 31 high and weekly R1.

We hold a bearish outlook on the New Zealand Dollar this week. The currency pair has recently broken through the long-term moving average and formed a descending channel. The near-term rallies are to be capped by the falling resistance line at 0.9426, while the target is the December 15 low at 0.9242. However, the upside risks are not negligible. First, most of the daily technical indicators are giving ‘buy' signals. Secondly, the Kiwi is oversold in the SWFX market, being that 73% of positions are already short. Above 0.9426 will likely aim for the 200-hour SMA at 0.9468 and the weekly PP at 0.9491. Additional resistance is at 0.9546/33, created by the December 31 high and weekly R1.

Tue, 05 Jan 2016 06:28:13 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.