Note: This section contains information in English only.

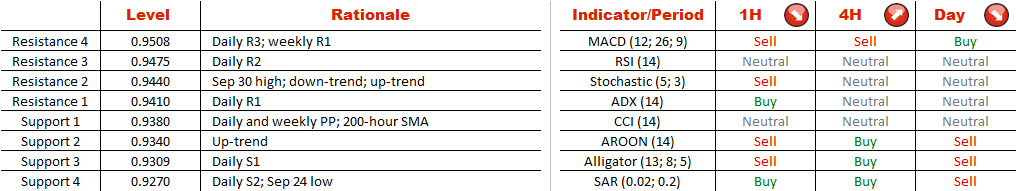

Although right now the Aussie is following a bullish trend, the rally's prospects are not bright. The reason is the falling resistance trend-line that connects August and September highs. Consequently, the base scenario is a failure at 0.9440 and a subsequent sell-off beyond the lower boundary of the bullish channel. In case AUD/CAD closes above 0.9440 against all odds, the new target will be last month's peak at 0.9522. At the same time, a breach of the trend-line at 0.9340 will imply an extension of a decline back to the Sep 24 low at 0.9270. Meanwhile, the SWFX traders' sentiment is neutral, as the difference between the share of bulls (55%) and bears (45%) does exceed 10 percentage points.

Although right now the Aussie is following a bullish trend, the rally's prospects are not bright. The reason is the falling resistance trend-line that connects August and September highs. Consequently, the base scenario is a failure at 0.9440 and a subsequent sell-off beyond the lower boundary of the bullish channel. In case AUD/CAD closes above 0.9440 against all odds, the new target will be last month's peak at 0.9522. At the same time, a breach of the trend-line at 0.9340 will imply an extension of a decline back to the Sep 24 low at 0.9270. Meanwhile, the SWFX traders' sentiment is neutral, as the difference between the share of bulls (55%) and bears (45%) does exceed 10 percentage points.

Thu, 01 Oct 2015 06:44:58 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.