Note: This section contains information in English only.

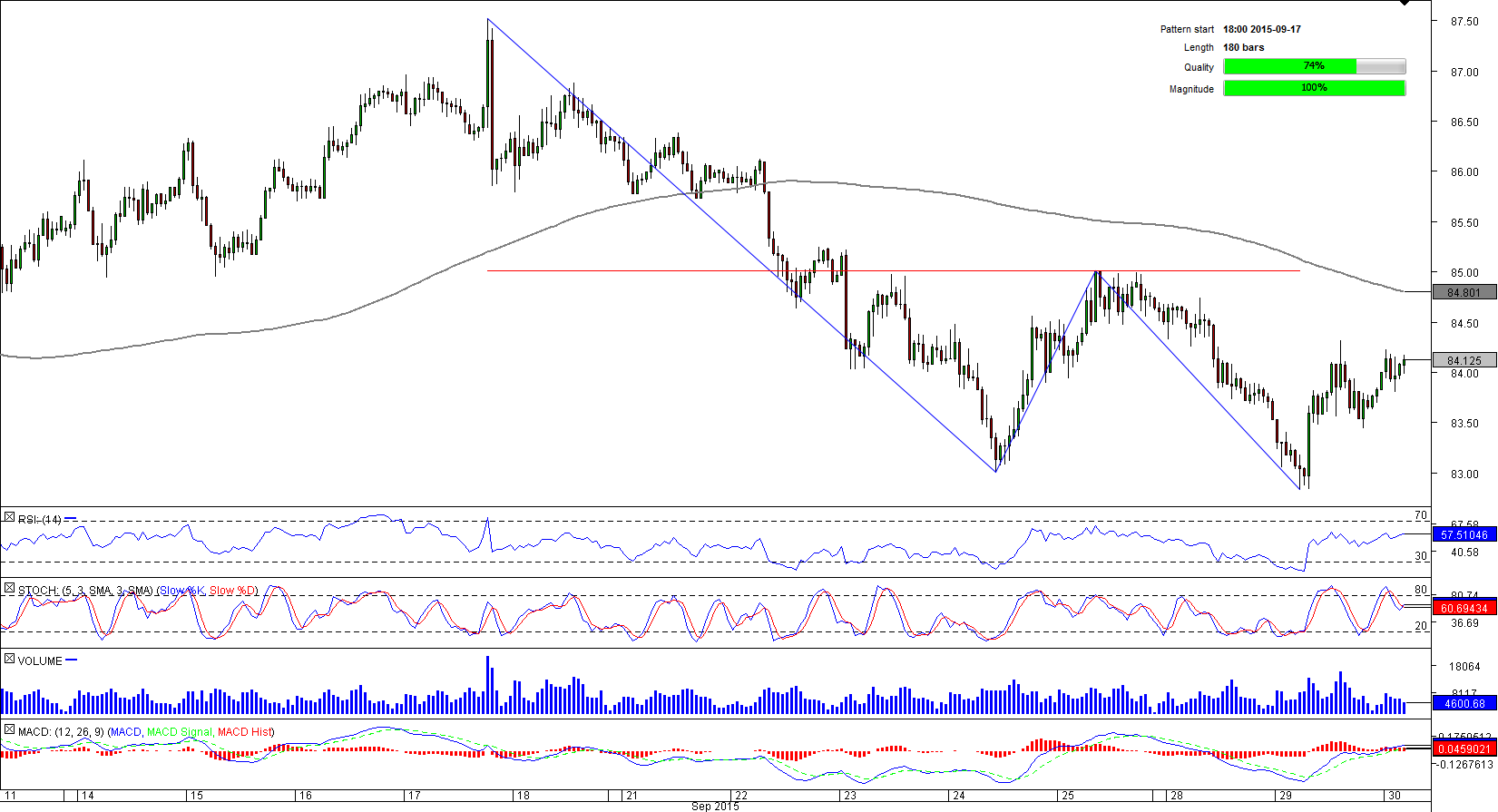

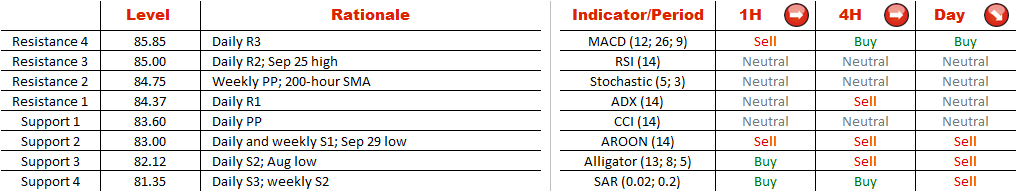

At the moment AUD/JPY is recovering from 82.80 and is thus approaching a key resistance area. The level of 85 yen is the neckline of the double bottom pattern, and if the pair manages to gain a foothold above it, the rally will likely extend up to 87.50, namely to the September high. At the same time, a failure to break supply zone created by the Sep 25 high, weekly PP and 200-hour SMA will likely force the rate to retreat back to 83 yen. Additional supports are at 82.12 and 81.35 represented by the August low and weekly S2, respectively. In the meantime, the sentiment of the SWFX market participants is distinctly bullish, being that 72% of open positions are currently long.

At the moment AUD/JPY is recovering from 82.80 and is thus approaching a key resistance area. The level of 85 yen is the neckline of the double bottom pattern, and if the pair manages to gain a foothold above it, the rally will likely extend up to 87.50, namely to the September high. At the same time, a failure to break supply zone created by the Sep 25 high, weekly PP and 200-hour SMA will likely force the rate to retreat back to 83 yen. Additional supports are at 82.12 and 81.35 represented by the August low and weekly S2, respectively. In the meantime, the sentiment of the SWFX market participants is distinctly bullish, being that 72% of open positions are currently long.

Wed, 30 Sep 2015 06:07:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.