Note: This section contains information in English only.

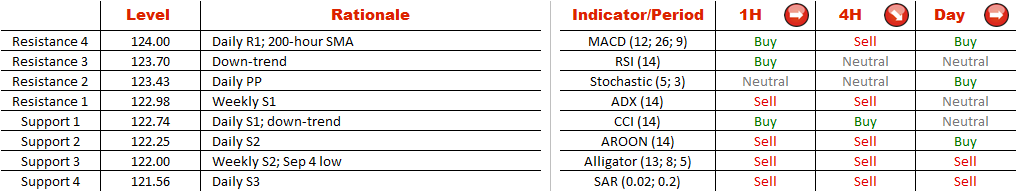

Although earlier this month it seemed that CHF/JPY was forming a bullish channel, in the end it proved to be a correction after the Aug 21 - Sep 4 selloff. Accordingly, the outlook is once again bearish, and this will be confirmed with a breach of the support at 121 yen, where the weekly S2 coincides with the Sep 4 low. Talking about the perspective in the next few days however, there is likely to be a small rally. The Swiss Franc is expected to recover from 122.74 up to 123.70, where the exchange rate should be rejected by the upper boundary of the channel. Meanwhile, the sentiment in the market is noticeably bearish, as two thirds of open positions are short.

Although earlier this month it seemed that CHF/JPY was forming a bullish channel, in the end it proved to be a correction after the Aug 21 - Sep 4 selloff. Accordingly, the outlook is once again bearish, and this will be confirmed with a breach of the support at 121 yen, where the weekly S2 coincides with the Sep 4 low. Talking about the perspective in the next few days however, there is likely to be a small rally. The Swiss Franc is expected to recover from 122.74 up to 123.70, where the exchange rate should be rejected by the upper boundary of the channel. Meanwhile, the sentiment in the market is noticeably bearish, as two thirds of open positions are short.

Wed, 23 Sep 2015 06:29:18 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.