Note: This section contains information in English only.

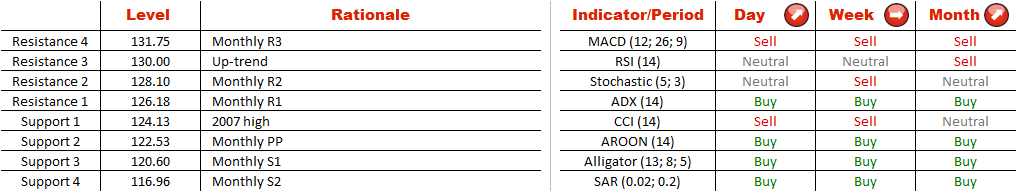

Judging by the situation on the weekly chart, we are currently in the upper part of the bullish channel, a fact that increases the downside risks. On the other hand, the bulls have recently proved their strength by throwing the Dollar above the 2007 high, and the technical indicators are largely pointing north. Still, a test of the resistance trend-line at the level of 130 yen is likely to lead to a start of a correction, which may extend down to the 2015 low at 116, also the lower edge of the pattern. There the bulls should regain control and commence a new up-leg. Alternatively, if resistance at 130 or support at 116 fails to contain the pair, we will expect a move towards the 2002 high at 135 or the 2014 low at 101, respectively.

Judging by the situation on the weekly chart, we are currently in the upper part of the bullish channel, a fact that increases the downside risks. On the other hand, the bulls have recently proved their strength by throwing the Dollar above the 2007 high, and the technical indicators are largely pointing north. Still, a test of the resistance trend-line at the level of 130 yen is likely to lead to a start of a correction, which may extend down to the 2015 low at 116, also the lower edge of the pattern. There the bulls should regain control and commence a new up-leg. Alternatively, if resistance at 130 or support at 116 fails to contain the pair, we will expect a move towards the 2002 high at 135 or the 2014 low at 101, respectively.

Mon, 08 Jun 2015 08:21:13 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.