Note: This section contains information in English only.

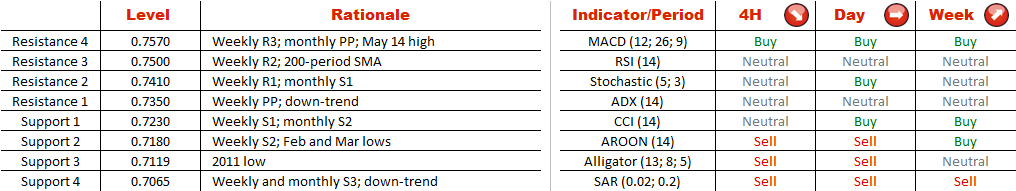

NZD/USD is apparently forming a downward-sloping channel, meaning the general outlook is bearish. If the New Zealand Dollar starts to recover, which may well be the case since the Kiwi is now facing support at 0.7230 (weekly S1 and monthly S2), the rally should be stopped by the upper boundary of the pattern at 0.7350. The target is the lower trend-line at 0.7065.

However, with every new red bar short bets are becoming more and more risky, being that the price is closing in on the major demand areas. The closest is around 0.7180, represented by the March and February lows. This zone is followed by the 2011 low at 0.7119.

NZD/USD is apparently forming a downward-sloping channel, meaning the general outlook is bearish. If the New Zealand Dollar starts to recover, which may well be the case since the Kiwi is now facing support at 0.7230 (weekly S1 and monthly S2), the rally should be stopped by the upper boundary of the pattern at 0.7350. The target is the lower trend-line at 0.7065.

However, with every new red bar short bets are becoming more and more risky, being that the price is closing in on the major demand areas. The closest is around 0.7180, represented by the March and February lows. This zone is followed by the 2011 low at 0.7119.

Thu, 28 May 2015 06:49:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.