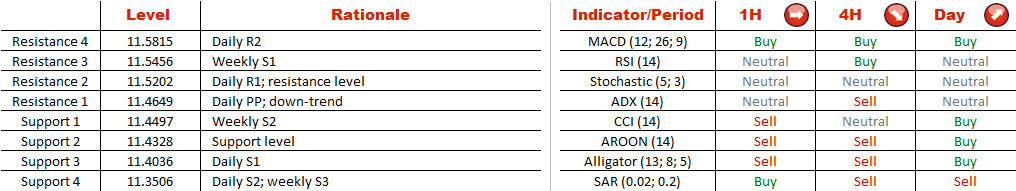

At the same time, if 11.4650 fails to keep the bulls at bay, the first notable supply zone will be between 11.5460 and 11.5200, while the weekly pivot point merges with the long-term SMA at 11.6450/11.6180 .

Note: This section contains information in English only.

Being unable to gain a foothold above 11.74, USD/ZAR began trading between two parallel bearish lines. This implies that the US Dollar is going to keep underperforming as long as the resistance trend-line is not breached. The base case scenario is a bounce off 11.4650 and a subsequent close beneath 11.4330. The next significant demand area will then be at 11.35, followed by the February low at 11.2630.

Being unable to gain a foothold above 11.74, USD/ZAR began trading between two parallel bearish lines. This implies that the US Dollar is going to keep underperforming as long as the resistance trend-line is not breached. The base case scenario is a bounce off 11.4650 and a subsequent close beneath 11.4330. The next significant demand area will then be at 11.35, followed by the February low at 11.2630.

At the same time, if 11.4650 fails to keep the bulls at bay, the first notable supply zone will be between 11.5460 and 11.5200, while the weekly pivot point merges with the long-term SMA at 11.6450/11.6180 .

Thu, 26 Feb 2015 06:28:05 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

At the same time, if 11.4650 fails to keep the bulls at bay, the first notable supply zone will be between 11.5460 and 11.5200, while the weekly pivot point merges with the long-term SMA at 11.6450/11.6180 .

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.