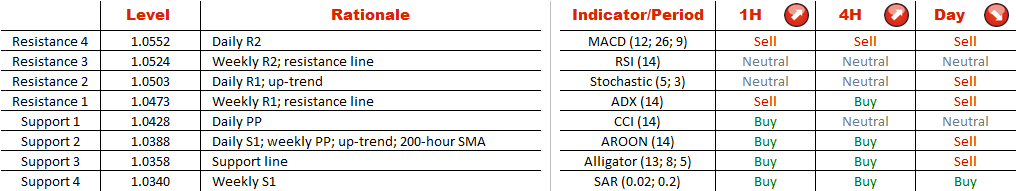

The Aussie is likely to slide beneath the daily pivot point at 1.0430 toward a cluster of supports at 1.0390, where the rising trend-line merges with the 200-hour SMA, weekly pivot point and daily S1 level. Here AUD/NZD should form a bottom. As for the sentiment, SWFX traders are mostly bullish: as many as 71% of open positions are long.

Note: This section contains information in English only.

While the market has been largely bearish since the end of January, AUD/NZD is currently developing a rally thanks to a solid demand near 1.03. However, in the very near-term the outlook is negative, being that the pair has just confirmed the upper boundary of the bullish channel at 1.0470.

While the market has been largely bearish since the end of January, AUD/NZD is currently developing a rally thanks to a solid demand near 1.03. However, in the very near-term the outlook is negative, being that the pair has just confirmed the upper boundary of the bullish channel at 1.0470.

The Aussie is likely to slide beneath the daily pivot point at 1.0430 toward a cluster of supports at 1.0390, where the rising trend-line merges with the 200-hour SMA, weekly pivot point and daily S1 level. Here AUD/NZD should form a bottom. As for the sentiment, SWFX traders are mostly bullish: as many as 71% of open positions are long.

Wed, 25 Feb 2015 06:40:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

The Aussie is likely to slide beneath the daily pivot point at 1.0430 toward a cluster of supports at 1.0390, where the rising trend-line merges with the 200-hour SMA, weekly pivot point and daily S1 level. Here AUD/NZD should form a bottom. As for the sentiment, SWFX traders are mostly bullish: as many as 71% of open positions are long.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.