Note: This section contains information in English only.

The Australian Dollar has been in decline for the past three years. However, right now we would rather focus on the last 150 days, as during them the currency pair has been trading between two parallel down-trends.

The Australian Dollar has been in decline for the past three years. However, right now we would rather focus on the last 150 days, as during them the currency pair has been trading between two parallel down-trends.

Mon, 10 Mar 2014 10:08:08 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

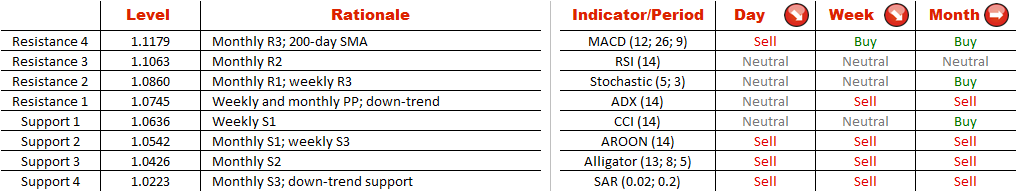

At the moment the exchange rate is fluctuating just below the upper boundary of the channel, meaning there are significant down-side risks. Additionally, most of the daily and weekly technical indicators are giving ‘sell' signals. Accordingly, AUD/NZD is likely to move away from the resistance at 1.0745 and head towards 1.0223, where we may expect a start of the bullish correction.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.