Note: This section contains information in English only.

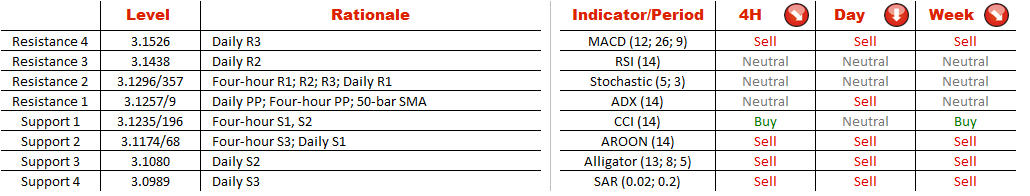

After hitting more than a one-year high of 3.3933 on July 10, USD/PLN reversed its trend and was gradually falling until it approached a seven-month low of 3.0630 on Sep 18. The pair bounced off this low to trade near 3.1207 (50-hour SMA, daily PP). The jump seems to have enfeebled the currency pair that is likely to retreated from the daily pivot point to test a bunch of support lines sitting at 3.1235/174 (four-hour S1, S2, S3). However, traders are holding an opposite belief, placing buy orders in 63.64% of cases. If traders' expectations materialize the pair will surpass daily pivot that will prompt a rebound to a four-hour resistance region at 3.1296/318 (four-hour R1, R2).

After hitting more than a one-year high of 3.3933 on July 10, USD/PLN reversed its trend and was gradually falling until it approached a seven-month low of 3.0630 on Sep 18. The pair bounced off this low to trade near 3.1207 (50-hour SMA, daily PP). The jump seems to have enfeebled the currency pair that is likely to retreated from the daily pivot point to test a bunch of support lines sitting at 3.1235/174 (four-hour S1, S2, S3). However, traders are holding an opposite belief, placing buy orders in 63.64% of cases. If traders' expectations materialize the pair will surpass daily pivot that will prompt a rebound to a four-hour resistance region at 3.1296/318 (four-hour R1, R2).

Tue, 01 Oct 2013 07:18:45 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.