Note: This section contains information in English only.

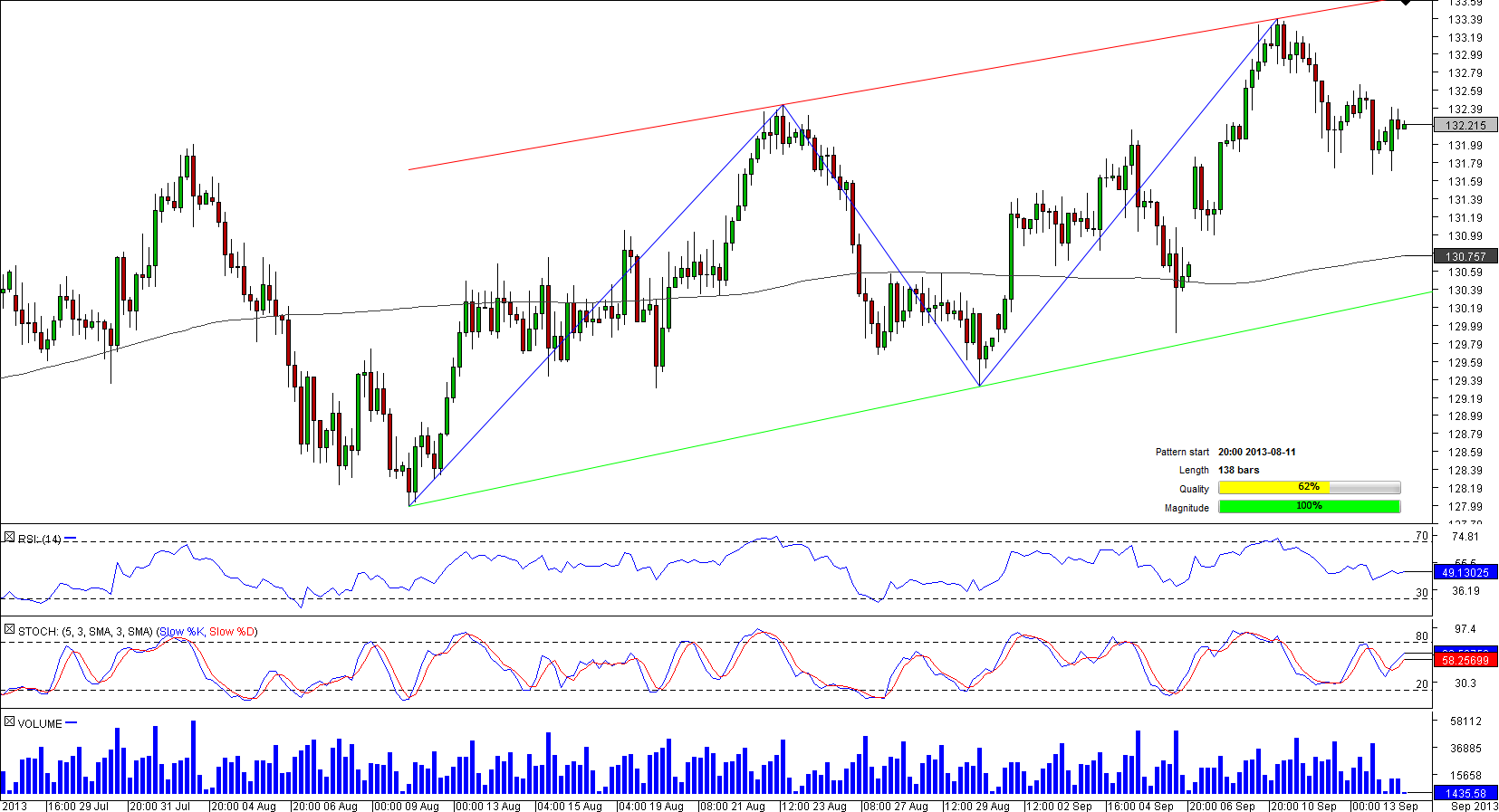

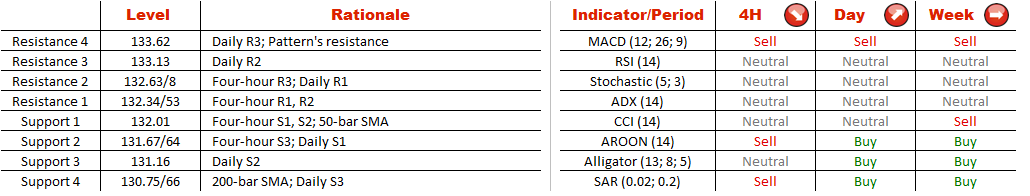

After tumbling to a one-month low of 127.97 on August 11, the currency couple commenced to form a channel up pattern that took the pair to a four-month high of 133.41 touched on September 10. Having reached this high, EUR/JPY retreated slightly to trade at its daily pivot point at 132.15 sitting right above the 50-bar SMA. The pair is likely to use its daily pivot point as a prop for an advance to the four-hour resistance zone at 132.34/53 (four-hour R1, R2). A breach through this region may enfeeble the pair, but EUR/JPY may still retain some strength to attempt to overcome the daily resistance at 132.63 (daily R1) that is the last defense against a sharp appreciation of the pair.

After tumbling to a one-month low of 127.97 on August 11, the currency couple commenced to form a channel up pattern that took the pair to a four-month high of 133.41 touched on September 10. Having reached this high, EUR/JPY retreated slightly to trade at its daily pivot point at 132.15 sitting right above the 50-bar SMA. The pair is likely to use its daily pivot point as a prop for an advance to the four-hour resistance zone at 132.34/53 (four-hour R1, R2). A breach through this region may enfeeble the pair, but EUR/JPY may still retain some strength to attempt to overcome the daily resistance at 132.63 (daily R1) that is the last defense against a sharp appreciation of the pair.

Mon, 16 Sep 2013 07:00:36 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.