Note: This section contains information in English only.

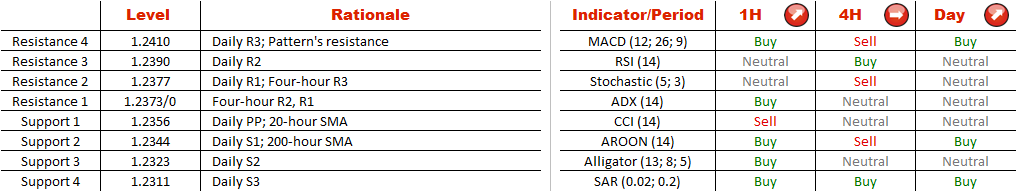

A formation of the rising wedge pattern by EUR/CHF started on August 20, a day after the pair fell below its 200-hour SMA that had served as a strong support zone for almost a week. The pair hit its 22-day low of 1.2282 on August 30 and commenced an upward trend until a three-week high of 1.2402 enervated the pair and sent it to the current level of 1.2367. Market players are bullish on the pair as the proportion of buy orders is near 64%. If EUR/CHF moves in line with traders' outlook, it will breach a cluster of four-hour resistances at 1.2370/4 (four-hour R1, R2, R3) and may continue rising until a formidable resistance at 1.2390 (daily R2) that acts as the last defence for the three-week high.

A formation of the rising wedge pattern by EUR/CHF started on August 20, a day after the pair fell below its 200-hour SMA that had served as a strong support zone for almost a week. The pair hit its 22-day low of 1.2282 on August 30 and commenced an upward trend until a three-week high of 1.2402 enervated the pair and sent it to the current level of 1.2367. Market players are bullish on the pair as the proportion of buy orders is near 64%. If EUR/CHF moves in line with traders' outlook, it will breach a cluster of four-hour resistances at 1.2370/4 (four-hour R1, R2, R3) and may continue rising until a formidable resistance at 1.2390 (daily R2) that acts as the last defence for the three-week high.

Tue, 10 Sep 2013 07:18:21 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.