Note: This section contains information in English only.

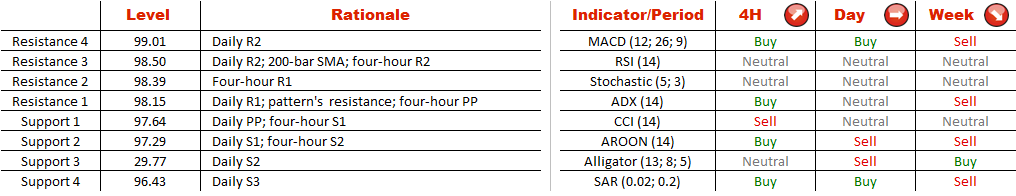

USD/JPY was initially trading above its 200-bar SMA that acted as a strong support zone for the pair. However, a plunge below its 200-bar SMA on July 26 triggered a deep sell-off. Having fallen to a one-month low of 96.57, the pair regained strength and attempted to consolidate above its 200-bar SMA, but USD/JPY did not succeed in its endeavour and fell to a pattern's support line that was at 95.83. Currently, the pair is trading near the pattern's resistance at 98.16. A rise above 98.15 (daily R1) and 98.50 (daily R2) would suggest a rally towards its 200-bar SMA, while a drop under 97.29 (daily S1) and 96.77 (daily S2) would bring a downswing back into the picture.

USD/JPY was initially trading above its 200-bar SMA that acted as a strong support zone for the pair. However, a plunge below its 200-bar SMA on July 26 triggered a deep sell-off. Having fallen to a one-month low of 96.57, the pair regained strength and attempted to consolidate above its 200-bar SMA, but USD/JPY did not succeed in its endeavour and fell to a pattern's support line that was at 95.83. Currently, the pair is trading near the pattern's resistance at 98.16. A rise above 98.15 (daily R1) and 98.50 (daily R2) would suggest a rally towards its 200-bar SMA, while a drop under 97.29 (daily S1) and 96.77 (daily S2) would bring a downswing back into the picture.

Thu, 22 Aug 2013 07:20:37 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.