The Stochastic and the RSI indicators send sell signals on 4H horizon indicating that the pair could attempt to move closer to 200 day SMA. Short traders should focus on the daily pivot (R2) at 1.0496. If this level is breached, next targets could be at daily pivots at 1.0472 (R1) and 1.0446 (PP).

Note: This section contains information in English only.

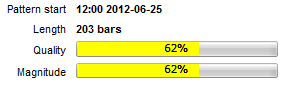

AUD/USD is recovering and has formed a Channel Up pattern on the 4H chart. The pattern has 62% quality and 62% magnitude in the 203-bar period.

AUD/USD is recovering and has formed a Channel Up pattern on the 4H chart. The pattern has 62% quality and 62% magnitude in the 203-bar period.

The Stochastic and the RSI indicators send sell signals on 4H horizon indicating that the pair could attempt to move closer to 200 day SMA. Short traders should focus on the daily pivot (R2) at 1.0496. If this level is breached, next targets could be at daily pivots at 1.0472 (R1) and 1.0446 (PP).

Tue, 21 Aug 2012 12:52:52 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

The pattern started when the pair bounced from 0.9969 and after testing pattern's support twice it slowed down not far above 200 day SMA at 1.0511 where the pair is currently trading. Technical indicator on aggregate point at appreciation of the pair on 1W horizon indicating that the pair should continue to follow pattern's upwards trend. Long traders could set targets at the 21st of August peak/daily pivot (R3) at 1.0519 and weekly pivot (R1) at 1.5770.

The Stochastic and the RSI indicators send sell signals on 4H horizon indicating that the pair could attempt to move closer to 200 day SMA. Short traders should focus on the daily pivot (R2) at 1.0496. If this level is breached, next targets could be at daily pivots at 1.0472 (R1) and 1.0446 (PP).

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.