Note: This section contains information in English only.

Fri, 20 Nov 2015 15:35:07 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"For now, the unwinding of positions built around the Fed tightening is dominating concerns about commodity weakness. I don't think it will last."

- Imre Speizer, Westpac Banking Corp. (based on Bloomberg)

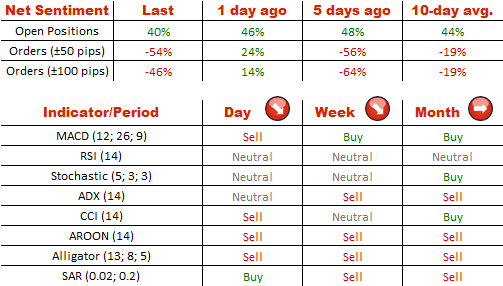

The Australian Dollar slightly overshot our target, as the exchange rate reached the 100-day SMA, rather than the expected 0.72 level yesterday. Nevertheless, the price still closed at 0.7193, with the pair now supported by the monthly PP and the weekly R1 around 0.7180. At the same time, the 100-day SMA keeps providing resistance, but AUD/USD is determined to pierce it, despite the technical indicators retaining bearish signals. If the Aussie preserves momentum against the US Dollar, the down-trend at 0.7230 could get tested today as well.

The sentiment is somewhat less bullish than yesterday. The percentage of bulls declined from 73 to 70%.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.