- Facts Global Energy (based on MarketWatch)

Note: This section contains information in English only.

"… a weak market in 2015 and even lower oil prices. Demand rebound will not save the oil market.''

"… a weak market in 2015 and even lower oil prices. Demand rebound will not save the oil market.''

- Facts Global Energy (based on MarketWatch)

Wed, 11 Feb 2015 17:24:01 GMT

Source: Dukascopy Bank SA

© Image watermark

- Facts Global Energy (based on MarketWatch)

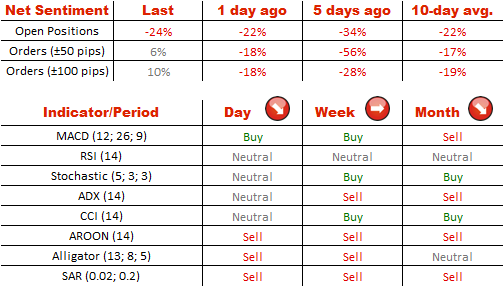

The cross continues to compete with the heavy resistance at 0.749, where the 38.20% Fibonacci and the May 2012 low levels are situated. The pair has been trading within the range between the November 2011 low at 0.733 and the area mentioned previously since 3 February. The 55– 100– and 200– day SMAs are pointing to the south and the daily sentiment remains bearish.

The sentiment from the pair's traders remains to be bearish since 62% of all hold the short positions. As a matter of fact, the market added some pending orders and the 50– pip ones are bullish for 53% of the case. Meanwhile, the 100– pip orders are placed to be bought by 55% of all traders.

© Image watermark

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.